Knowledge base \ Expense Connect

Expense Connect Article

Knowledge base \ Expense Connect

Expense Connect Parameters

The configuration of Expense Connect in MS Dynamics 365 is legal entity specific. So the configuration steps outlined below must be repeated for every legal entity that you have an Expensify policy for.

Project Parameters

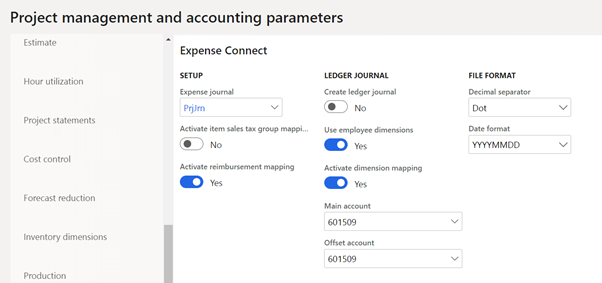

Path: Project Management & Accounting à Setup à Project Management and Accounting Parameters à Expense Integration

In the parameter section you can configure the behaviour of the import to fit your accounting needs, allowing you to reimburse employees and use the identified TAX/VAT codes from Expensify on the postings.

Expense Journal – Here you must select the journal that is used for the transactions, this allows for the use of separate voucher and also makes it easy to identify the transactions coming from Expensify.

Activate reimbursement mapping – If this is selected then the connector will use the mapping from “Reimbursable transaction mapping” to identify the transactions that are reimbursable and if they are identified as reimbursable then the system will use the vendor that’s associated with the employee as the offset, allowing for expenses to be reimbursed through the standard payment process. If it’s left blank then the connector will offset everything against the ledger using the standard posting profiles.

Activate item sales tax group mapping – If this is selected then the connector will use the “Item sales tax group mapping” to assign the correct item sales tax group to the transaction based on how these has been mapped to the TAX/VAT codes from Expensify. If it’s left blank, then the system will just use the default Dynamics configuration.

Create ledger journal – If the expenses should be created as a ledger journal instead of a project journal then this parameter must be set to “yes”, if it’s set to “no” then the system will try and create a project expense journal.

Use employee dimensions – this parameter only applies to ledger journal creation, if it’s set to “yes” then the system will apply the dimensions from the worker to the ledger entries.

Activate dimension mapping – this parameter only applies to ledger journal creation, if it’s set to “yes” then the system will apply the dimensions from the dimension mapping table, using attributes received from the external system to construct the dimension string. This can be used in together with the employee dimension parameter.

Main Account – this parameter will default a main account to the ledger entries, in case no main account is received from the external system.

Offset account – this parameter will default an offset account to the ledger entries, in case no offset account is received from the external system.

Decimal separator – this parameter is used for manual imports of csv files, and tells the system what kind of decimal separator to expect in the file

Date format – this parameter is used for manual imports of csv files, and tells the system what kind of date format to expect in the file.